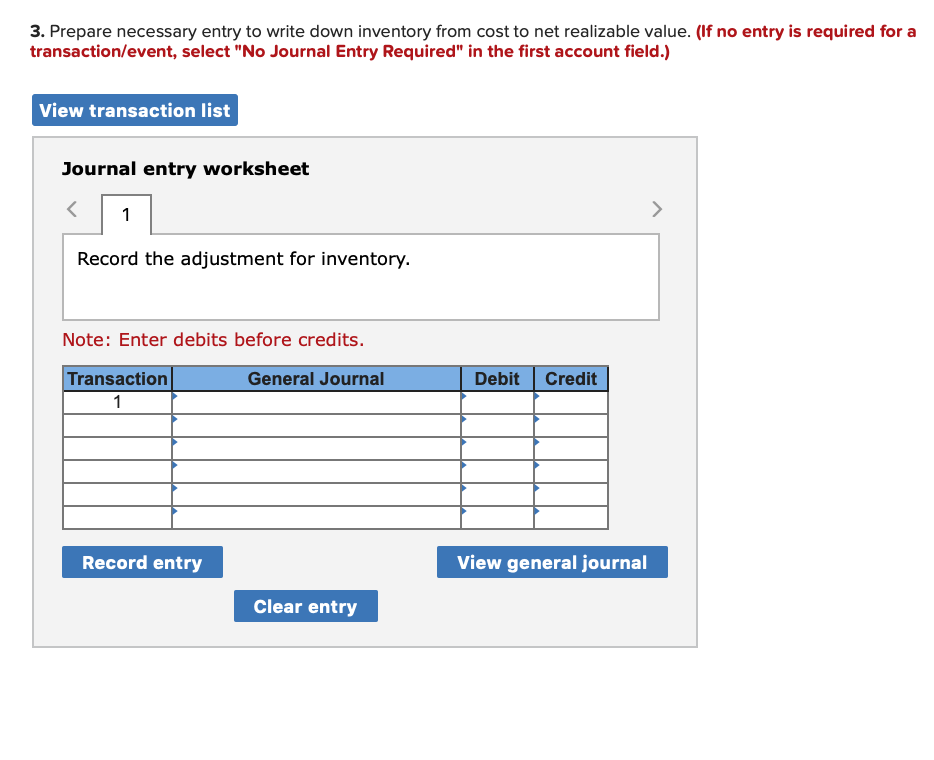

If you are aware of an inventory issue that requires a write-down, charge the entire amount to expense at once.

Inventory writedown cogs full#

This approach immediately recognizes the full amount of the loss, even if the related inventory has not yet been disposed of. Then, as items are actually disposed of, the reserve would be debited and the inventory account credited. Write-downs reduce the value of inventory, and the loss in value (expense) is generally reflected in the income statement in the cost of goods sold. Generally you will see the adjustment/write-down either in COGS, if relatively small, or as an income statement operating expense if larger. The reserve would appear on the balance sheet as an offset to the inventory line item. Inventory has lost value If the inventory can be bought today for substantially less than what it cost when purchased, the write-down is necessary to reflect that loss in value.

This would be a debit to the cost of goods sold expense and a credit to the reserve for obsolete inventory account. If inventory has been tagged for disposition but has not yet been disposed of, the accounting staff should immediately create a reserve (contra account) for the total amount that is expected to be lost from the disposition of the identified items. Otherwise, the inventory asset will be too high, and so is misleading to the readers of a company's financial statements. This should be done at once, so that the financial statements immediately reflect the reduced value of the inventory. Inventory is written down when goods are lost or stolen, or their value has declined. The write down of inventory involves charging a portion of the inventory asset to expense in the current period.

0 kommentar(er)

0 kommentar(er)